As January 2026 unfolds, a series of financial changes are set to reshape how we manage money. Whether it's your salary, loans, or daily expenses, these updates will undoubtedly touch various aspects of your financial life. It's time to dive into these changes and understand their implications.

One of the most significant updates is the introduction of weekly credit score updates. This means you can now monitor your credit health more regularly, allowing you to make informed financial decisions and address any discrepancies before they escalate. It's a proactive step towards maintaining a strong credit profile that could benefit your borrowing opportunities.

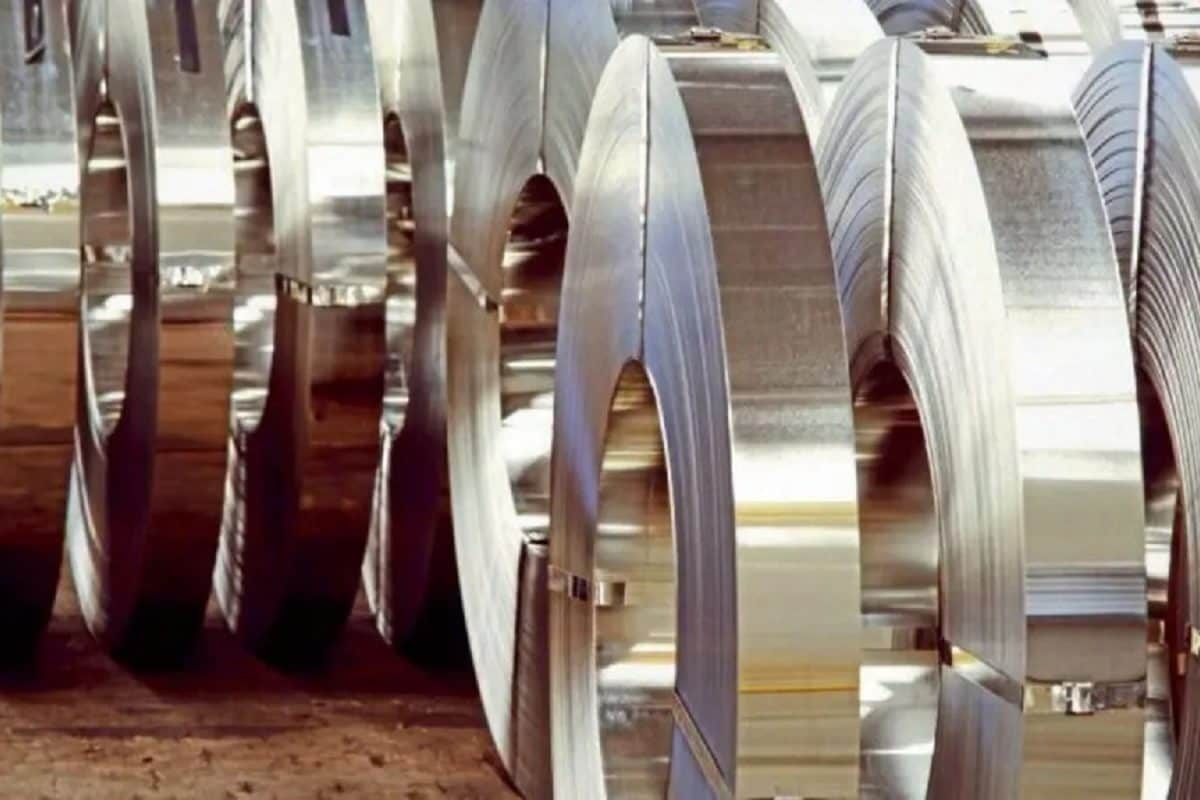

In a move to make borrowing more affordable, several leading banks including SBI, PNB, and HDFC have announced reduced loan rates. This reduction is good news for potential homebuyers and anyone looking to refinance existing loans. Lower interest rates can translate into substantial savings over time, making that dream home or debt-free life more achievable.

Moreover, the implementation of the 8th Pay Commission may bring changes to government salaries, potentially enhancing purchasing power for many employees. Additionally, with the new mandate to link PAN and Aadhaar, ensuring your tax and identity documentation is in order has never been more crucial. As you prepare to file taxes, keep an eye out for the updated ITR forms designed to simplify the process.